Interest Only Mortgage

Interest Only mortgages are the cheapest of the three repayment types. They were originally introduced to be used in connection with a mortgage investment product such as an endowment that would repay the mortgage and possibly provide a lump sum as well.

Interest Only mortgages are the cheapest of the three repayment types. They were originally introduced to be used in connection with a mortgage investment product such as an endowment that would repay the mortgage and possibly provide a lump sum as well.

Interest only mortgages are less popular today due as people have been stung by under-performing investments and endowment policies in the past. Due to torrid market conditions, some of these policies matured with a far lesser sum than expected and leaving the borrower to make up the shortfall from their own funds.

What is an interest only mortgage?

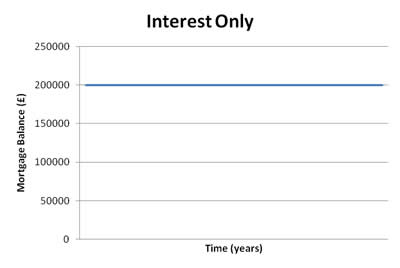

An interest only mortgage is one where only the interest is repaid from your monthly repayments therefore keeping the balance of the mortgage at the same level as what you originally borrowed. As only the interest is repaid and never the capital, the payments are cheaper than capital & interest and part & part mortgages.

Whilst this is a great benefit, you need to be aware that you must establish a separate long term repayment strategy as you will owe the original balance at the end of the term. This can be done via an investment plan, inheritance or selling the property in the future.

There are three main types of investment plan that can be used to repay the mortgage; an ISA (individual savings plan), pension or an endowment. The investment plan does not have to be provided by the mortgage lender.

A graph illustration how a £200,000 interest only mortgage would be repaid over time

Interest only mortgages can be particularly useful for short term mortgages such as if you're looking to move house within a couple of years as they will keep your costs low during this period. They are also useful for first time buyers who are looking for low mortgage payments. As interest only mortgages can be changed to a repayment mortgage in the future, they are becoming increasingly popular with first time buyers who are finding it increasingly difficult to afford the mortgage payments. Several lenders are now packaging interest only mortgages as a specifically designed product to attract first time buyers. However, you will find that most lenders will offer the main mortgage products on an interest only basis. It is worth noting that taking an interest only mortgage with the intention of changing to a capital and interest mortgage in the future may incur a small fee from your lender.

There is also a greater risk of negative equity (especially if borrowing at a high loan to value) with interest only mortgages as the capital never reduces. It is strongly recommended that you do not rely on an increase in the price of your property to pay off the capital debt at the end of the mortgage term.

It is worth mentioning that interest only mortgages are only cheaper in the short term and actually work out more expensive if continued through the entire term of the mortgage. The difference between interest only and repayment is illustrated below using a 25 year £200,000 mortgage as an example.

| Repayment Mortgage | Interest Only Mortgage | |

| Original amount borrowed | £200,000 | £200,000 |

| Monthly repayment | £1,366.35 | £1,083.33 |

| Total repayment over 25 years | £409,905 | £325,000 |

| Balance remaining after 25 years | £0 | £200,000 |

| Total amount payable | £409,905 | £525,000 |

Advantages of Interest Only mortgages

- The monthly repayments are lower

- Ideal for short term mortgages such as if you're looking to move home in a couple of years and want to keep costs down

- Great for First Time Buyers who are struggling to afford the payments

- You can choose an 'investment vehicle' that is tax efficient to repay the capital

- If your investment grows quicker than estimated from the outset, you may be able to pay off your mortgage early or receive a lump sum at the end of the repayment period. This is in addition to paying off your mortgage

Disadvantages of Interest Only mortgages

- Only the interest is repaid and the full amount of capital will be outstanding at the end. You must have some method of repaying this at the end of the term

- There is a greater risk of negative equity as the capital never reduces

- There is no guarantee that you will have sufficient funds to pay off the mortgage at the end of the repayment period, as the investment could perform worse than anticipated

- Some forms of investment may incur a penalty fee if you stop paying premiums

Summary

- An interest only mortgage is one where only the interest is repaid from your monthly repayments therefore keeping the balance of the mortgage at the same level

- You will need to establish a separate long term repayment strategy to repay the capital at the end of the term which does not have to be provided by the mortgage lender

- There is no guarantee that you will have sufficient funds to pay off the mortgage at the end of the repayment period and you are at greater risk of negative equity

For more information about 'Interest Only Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: