Mortgage Repayment Type

There are thousands of mortgage products to choose from and picking the most suitable one can be a tough decision. To make matters worse, each mortgage can also have a different repayment type each of which affect the mortgage in a very different way.

It is crucial that you understand the difference between these mortgage repayment types and choose the one most suitable for your circumstances.

the types of repayment method

There are three main types of mortgage repayment method; capital & interest, interest only and part & part. These three repayment types will have very different monthly repayments and affect the mortgage in very different ways. Below is an explanation of each repayment method.

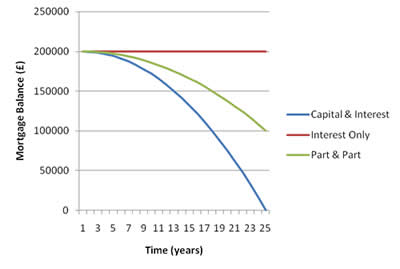

The difference between repayment types for a £200,000 mortgage

Capital & Interest

Capital & interest is the most common form of repayment method. This is when the loan is guaranteed to be repaid by end of the mortgage term (providing all mortgage payments are made on time) and is the only repayment method able to guarantee this.

Capital & interest mortgages have higher mortgage payments than the other two repayment types as an additional amount is required to reduce the capital each month.

You may notice from the graph above that the balance does not reduce in a straight line as you may expect, this is because initially, the majority of the mortgage payment will go towards repaying the interest and a small amount towards the capital. However, as the capital reduces each month, the interest charged will also reduce meaning more and more of your mortgage payment go towards repaying the capital. The mortgage payments towards the end of the term will go predominantly towards reducing the capital.

Interest Only

Interest only is the cheapest of the three repayment types. Here, only the interest is repaid from month to month keeping the balance of the mortgage at the same amount as what you borrowed.

Interest only mortgages can be particularly useful for short term mortgages such as if you're looking to move within a couple of years or even to keep the repayments low. You should be aware that the original amount borrowed will be due at end of term and so you will need to have some way of repaying this.

There is also a greater risk of negative equity (especially if borrowing at a high loan to value) with interest only mortgages as the capital never reduces.

Part & Part

Part & part mortgages are the least common form of mortgage and rarely used these days. They were initially introduced to be used alongside an endowment policy (an investment policy that you pay into monthly to hopefully receive a massive lump sum at the end).

The graph above shows a part and part mortgage where £100,000 is on capital and interest and £100,000 on interest only. Here you can see the balance reducing as the £100,000 capital portion is repaid. At the end of the term, the balance remaining is £100,000 (the amount of the interest only portion). It is at this time that the endowment policy would mature and repay the remaining £100,000.

During the 1990s, the financial market was very strong and many endowment policies were being used to successfully repay mortgages as well as provide a bonus lump sum, however, after the market crash in the early 2000's, many people were stuck with a shortfall. Since then, endowment policies are rarely sold.

Part & part mortgages do not necessarily have to be used in conjunction with endowment policies and can instead be used if you are expecting some form of windfall such as inheritance, a work bonus or even if you feel you have a lucky lottery ticket (although it's not recommended you structure your mortgage around this!).

Summary

- There are three main types of mortgage repayment method; capital & interest, interest only and part & part

- The most common form of repayment type is capital & interest

- A capital & interest mortgage type will ensure the mortgage is repaid in full at the end of the term

- An interest only mortgage will only repay the interest. The amount originally borrowed will be outstanding at the end of the term

- Part & part mortgages are a mixture of the other two and have two parts. One part is on capital and interest where the capital is repaid in full whilst the other part will only have the interest paid off. You can choose the amounts of each part

For more information about 'Mortgage Repayment Type', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: