Variable Rate Mortgages

Variable rate mortgages are one of the most popular choices of mortgage product within the mortgage industry (particularly in the UK) primarily because of the lower interest rates they can offer compared to other products. According to the Council of Mortgage Lenders, fixed rate mortgages account for seven out of ten new mortgages taken out in Britain, whilst variable rate discounted or tracker deals make up the majority of the remainder of new homeloans. Whilst variable rate mortgages are often cheaper than their fixed counterparts, this is not always the case and careful consideration must be taken to ensure the mortgage product you select suits your needs.

What is a Variable Rate Mortgage?

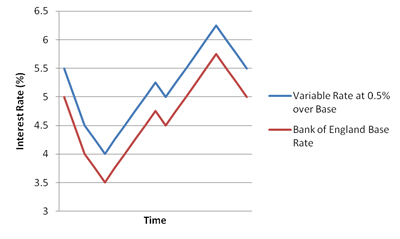

A variable rate mortgage is one where the interest rate reflects the market. As the name suggests, the interest rate will vary in accordance with the Bank of England Base Rate, typically no more than once a month. Variable rate mortgages are also known as floating rate mortgages as the interest rate is said to 'float' at a certain percentage above Base Rate. In essence this means that if the Bank of England Base Rate goes up, the variable rate increases, if the Bank of England Rate goes down, the variable rate decreases. Variable rate mortgages do not necessarily have to follow the Bank of England Base Rate and can instead follow LIBOR or the mortgage lenders' own standard variable rate.

Example of a variable rate mortgage against the Bank of England base rate.

Generally, variable rate mortgages do not carry a product term as they will continually follow the Base Rate until the product is changed.

Variable rate mortgages do not typically have an Early Redemption Charge attached unless you have chosen a specific product such as a capped or discounted rate. For these products, redemption charges may be added in exchange for offering a lower interest rate.

A common idea is to take advantage of the zero Early Redemption Charge and frequently switch variable mortgage products to ensure you're always getting the best interest rate. Caution is advised here as remortgaging often involves charges such as arrangement fees for the new mortgage product and even another valuation fee if you move to another lender. It is therefore more prudent to only change your mortgage product when you must or when it is financially economical to do so.

Advantages of Variable Rate Mortgages

- Variable interest rates are typically lower than that their equivalent fixed interest rates

- Your mortgage repayments are recalculated whenever there is an interest rate change

- Should interest rates decrease, you will immediately receive the benefit and your mortgage repayments will be reduced accordingly

- Generally no Early Redemption Charge (excluding some specific products such as discounted, cashback or capped rate mortgages)

- You have the ability to overpay the mortgage (excluding some specific products such as discounted, cashback or capped rate mortgages)

Disadvantages of variable Rate Mortgages

- The main disadvantage of variable rate mortgages is the lack of certainty of repayments and exposure to interest rate increases. Should interest rates rise, your mortgage repayments will increase in line with this. You must ensure you can afford the repayments in these circumstances

Advice when choosing a variable rate mortgage

- Variable rate mortgages can be risky as you have no certainty of what your repayments will be. It is therefore advisable to ensure you will still be able to afford the repayments if rates increase by a few percent

- There are many types of variable rate mortgage and options are available to mitigate against interest rate increases (such as capped rate mortgages) whilst receiving some of the benefits of a variable rate mortgage

- Early Redemption Charges generally do not apply with a variable rate mortgage providing you have not opted for a specific mortgage product such as a discounted, cashback or capped mortgage, it is advisable to read the mortgage offer carefully to see whether an Early Redemption Charge is applicable and how much it would cost

For more information about 'Variable Rate Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: