Capped Rate Mortgage

With a capped rate mortgage, you get the best of both worlds. Not only do you get a variable rate so you can benefit from any interest rate decreases but you also have the peace of mind knowing that your rate cannot go above a predetermined limit.

What is a Capped Rate Mortgage?

Capped rates work in a similar way to variable rates but offer a similar peace of mind to that you get from fixed rates. The variable interest rate is set at a certain level above the Bank of England Base Rate but the cap element means cannot go above a maximum predetermined amount.

e.g. A variable rate mortgage at 0.75% over Base capped at 6.5% would mean that if the Bank of England Base Rate is below 5.75% (6.5% - 0.75%), your interest rate would track at 0.75% above Base. If Base Rate is 5.75% or above, your rate would revert to the capped element and stay at 6.5% until Base Rate drops below 5.75% again.

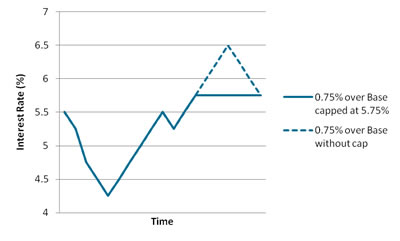

The graph below demonstrated this effect:

Example of the savings with a capped rate mortgage against a non-capped variable rate.

It is worth mentioning that you don't get something for nothing and capped rate mortgages typically have a slightly higher interest rate than their non-capped equivalents. In exchange for the cap protection, a lender will offer a higher interest rate to mitigate their risk. Secondly, capped rate mortgages usually have an early repayment charge associated with them.

Capped rates are mainly available for 2,3 and 5 years although longer terms are available and there are even some 'capped for life' products available.

Once the product term has expired, the interest rate will usually revert to the lender's Standard Variable Rate and you will be free to switch mortgage products or lenders (providing the lender has not imposed an overhanging early repayment charge).

You may also find some capped rate mortgages that also include a a lower limit 'a collar' that the interest rate cannot go below. These are known as cap & collar mortgages.

Advantages of capped Rate Mortgages

- With a capped rate mortgage, you get the best of both worlds. You have a variable interest rate allowing you to benefit from any decreases in interest rates and a capped element which ensures you know the maximum you will have to pay if rates increase

- Capped rate mortgages offer a similar peace of mind that fixed rate mortgages provide as your rate cannot go above the cap

Disadvantages of capped Rate Mortgages

- Typically, capped rate mortgages have a higher interest rate than their non-capped equivalent

- The cap is generally set at a relatively high value (usually higher than current fixed rates) to allow for increases. If you feel rates are going to increase, you may be better off with a fixed rate mortgage

- There are usually Early Repayment Charges associated with capped rates. If rates increase, you will be committed to paying the higher interest rate and will have to pay to switch to another product with a lower rate

Advice when choosing a capped rate mortgage

- Have an idea as to how you feel interest rates are going to move. If you think they're going to increase, you should consider a fixed rate. If you feel they're going to drop but want protection in case they increase, then a capped rate may be the product for you

- Check the Early Repayment Charge. You must know for how long you are committing to the mortgage and how much you'll need to pay if you wanted to exit early. Be cautious of overhanging early repayment charges

For more information about 'Capped Rate Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: