Discounted Rate Mortgage

There are many types of variable rate mortgages available on the market such as a standard variable rate or a tracker rate. An alternative to the popular tracker rate is the discounted rate mortgage.

What is a discounted rate mortgage?

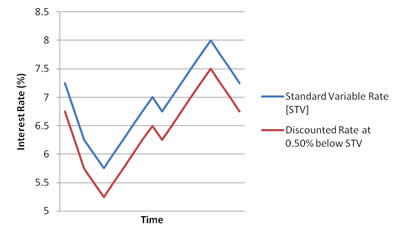

A discounted rate mortgage is a type of variable rate mortgage. Discounted mortgages are called such because they follow a certain level (a discount) below the lenders own Standard Variable Rate. This means they are very similar to tracker mortgages that are a certain level above the Bank of England Base Rate [BoE Base Rate].

The lenders' standard variable rate usually follows BoE Base Rate and has a guarantee that it will be no more than a certain percentage above Base Rate.

Lenders use their own standard variable rate as opposed to BoE Base Rate as it allows them more control over interest rates as they can delay interest rate decreases for a short time therefore gaining a small benefit before passing the lowered interest rate to its customers. This can also work the other way and lenders may delay interest rate increases from the BoE Base Rate therefore giving you more time on the lower interest rate.

The lender does not necessarily have to alter their standard variable rate by the same amount that BoE Base Rate changes, however they must ensure they stay within their Base Rate Guarantee. For example; if BoE Base Rate increases by 0.25%, some lenders may increase their Standard Variable Rate by 0.2%, some by 0.25% and others by 0.3%. It all depends on how the lender is positioned financially.

There is typically not a huge difference between the interest rates of tracker and discounted rates. The difference being more to do with the timing of interest rate changes rather than amounts.

There is also a psychological element involved in the sales of discounted rate mortgages. Whilst the interest rates will be fairly similar, it sounds better quoting a rate as a discount. e.g. Standard Variable rate - 1.5% sounds more appealing than BoE Base Rate + 1.5%.

advantages of discounted rate mortgages

- Every lender will have a standard variable rate guarantee to ensure that the level is no more than a stated level above the BoE Base Rate

- If interest rates go up, the lender may choose to delay the change to their variable rate therefore giving you more time on the lower interest rate

- Lenders do not have to change their standard variable rate by the same margin as the BoE Base Rate change. This means their variable rate could increase by a smaller amount than BoE Base Rate. They may also decide to decrease their rate by more than the BoE Base Rate if rates drop

Disadvantages of discounted rate mortgages

- If interest rates go down, the lender may decide to delay the change to their variable rate therefore you may not immediately see the benefit of the BoE Base Rate change

- The lender may increase their variable rate by more than than the BoE Base Rate change (but within their Base Rate guarantee) . They can also decrease their variable rate by a lesser margin than the BoE Base Rate if rates drop

advice when choosing a discounted rate mortgage

- Remember that discounted rates follow the lenders' Standard Variable Rate not the Bank of England Base Rate

- Every mortgage lender with have a guarantee that their standard variable rate will be no more than a certain level above the Bank of England Base Rate. It is important that you are aware what this maximum level is

- If it is possible, check the historic changes to the lenders' standard variable rate compared to Bank of England Base Rate changes. This will give you an idea as to how quickly the lender passes on any benefits of interest rate decreases and how much of the decrease they pass on

For more information about 'Discounted Rate Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: