Capital & Interest Mortgage

A capital & interest (otherwise known as 'repayment' or 'amortising') mortgage was the original method of repayment.

Capital & interest repayment is by far the most common form of repayment type due to the assurance it provides that the mortgage will be repaid in full at the end of the mortgage term.

What is a Capital & Interest mortgage?

A capital & interest mortgage is where your mortgage repayments go towards reducing the capital (also called principal) and the mortgage is guaranteed to be repaid at the end of the mortgage term (providing all repayments are made on time). Capital & interest is the only repayment method that can guarantee the mortgage is fully repaid.

Capital & interest mortgages generally have higher mortgage payments than other repayment types (interest only and part & part) as the mortgage payments, which are typically made monthly, contain a capital (repayment of the principal) and an interest element.

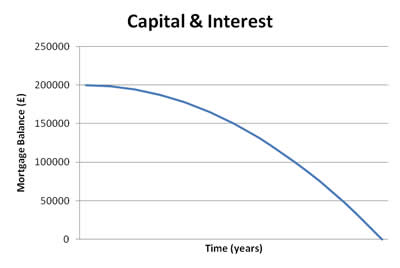

A graph illustration how a £200,000 capital & interest mortgage would be repaid over time

You can see from the graph above that the balance does not reduce in a straight line as you may expect. This is because during the initial months of the mortgage, your payment goes predominantly towards paying interest and a small amount to reducing the capital. As the mortgage progresses, the capital is slowly repaid meaning less interest is charged and so more of the capital is repaid. In the final stages of a mortgage, your payment goes mainly towards reducing capital.

Mortgages are repaid in this way because the payment amount is determined from the outset and is calculated to ensure the loan is repaid at the end of the term. This gives borrowers the peace-fo-mind that by maintaining repayments, the loan will be cleared at a specified date (assuming interest rates does not change).

Advantages of Capital & Interest mortgages

- Ensures that the mortgage is fully repaid

- Monthly repayments are determined from the outset

Disadvantages of Capital & Interest mortgages

- Mortgage payments are likely to be higher than other repayment types

Summary

- Capital & Interest mortgages ensure the loan is fully repaid by reducing the capital

- They are the most common form of mortgage repayment type

For more information about 'Capital And Interest Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: