Offset Mortgage

Offset mortgages can be a fantastic way to save thousands of pounds in interest over the term of your mortgage if you have savings.

Offset mortgages were first introduced in 1997 through Britannic Money's Current Account Mortgage where they offered a standard current account that was linked to the mortgage. Virgin One's One Account now run by Royal Bank of Scotland followed shortly afterwards.

What is an Offset Mortgage?

An offset mortgage (sometimes referred to as a 'current account mortgage') is where a savings account and/or current account deposit is rolled together with a mortgage. The principle is that the balance of any savings is set off against the balance on the mortgage and so you only pay interest on the difference.

Offset mortgages can be a great way of saving huge sums of money by reducing the amount of interest you need to pay.

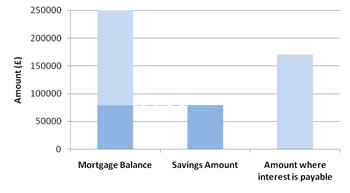

A £250,000 mortgage that is offset against £80,000 of savings. Interest payable is only calculated on the difference of £170,000. If at a rate of 5.69%, this would equate to £4,552 less interest each year.

There are two main types of offset mortgage:

- 1. The interest payable on the mortgage is reduced and no interest is paid on savings

- 2. The interest payable on the mortgage remains the same but interest on the savings accrues at the same rate as the mortgage (generally higher than savings product interest rates)

The net effect of both types of offset mortgage is the same, however, the first option has certain taxation advantages. If no interest accrues on the savings, no tax is payable.

In some instances, if the lender feels the level of savings is too high compared to the mortgage balance, they may choose to inlink the accounts (remember the lender still needs to make a profit at the end of the day). If this occurs, both the savings accounts and mortgage will have interest applied in the normal way as if there was no offset facility. This is very rare and you should check with the lender what their policy is in this instance.

Advantages of Offset Mortgages

- An offset mortgage can save you thousands of pounds in interest in long run

- There is typically no minimum amount of savings required to qualify

- You will have instant access to your savings at any time. This is an advatage over flexible mortgages where a redraw facility may take a few days

- Offset mortgages can be used to reduce the amount of tax you have to pay

Disadvantages of Offset Mortgages

- If opting for the zero interest on savings option, this will not keep up with inflation and so will be devalued over time

- The interest rates of offset mortgage may not be as competitive as other offerings

- Most lenders will require you to move your current account with them and have your salary paid into that account

Advice when choosing an Offset mortgage

- Offset mortgages or Current account mortgages are only worthwhile if you have a significant amount of savings to offset as the interest rate is generally higher than other products on the market

- You should decide how much access you will need to your savings and how often you are able to save. If you have a large amount of savings or are able to save regularly then and offset may be a good idea. If don't need access to savings and won't be looking save any additional amounts in the future, a flexible mortgage may be more suitable and will probably be at a lower interest rate

For more information about 'Offset Mortgages', you can call us on 020 8783 1337 or submit an online quote.

Bookmark with: